Import Certification and Delivery Verification

Learn about the Import Certificate and Delivery Verification, including their purpose and requirements, when to apply for each, and the application process.

On this page

The Import Certificate and Delivery Verification (ICDV) complement the export control requirements of the foreign exporting country.

An Import Certificate (IC) confirms that Singapore has no objection to the import of specific goods for the declared end-use and approved end-user.

A Delivery Verification (DV) confirms that goods imported under an IC have arrived in Singapore.

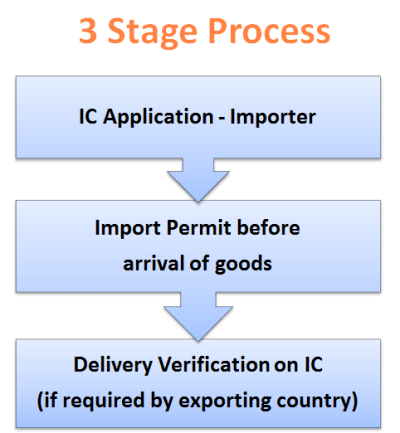

Import Certificate and Delivery Verification (ICDV) Process

Stage 1: IC Application

Apply for an IC through Singapore Customs if:

The goods to be imported into Singapore are controlled by the exporting country.

The exporting country requires an IC for the shipment.

Stage 2: Import Permit

Before the goods enter Singapore, obtain an import permit via TradeNet.

Stage 3: DV Application

After the goods have arrived in Singapore, apply for a DV if requested by the exporting country.

Three-stage ICDV process: Importers apply for an Import Certificate, obtain an import permit before goods arrive, and complete Delivery Verification if required by the exporting country.

Applying for an Import Certificate (IC)

Before You Apply

Ensure that you have:

An activated Customs Account

Inter-Bank GIRO (IBG) set up

Information Required

When submitting an IC application, provide:

Applicant details (full name, designation, contact details)

Unique Entity Number (UEN)

Exporter and end-user details (name and address)

Intended purpose (use in Singapore or re-export destination)

Item details (up to 10 items per application), including:

Exact description matching the exporter’s and end-user’s declarations

8-digit Harmonised System (HS) code, quantity and unit of measurement

Cost, Insurance and Freight (CIF) value in Singapore dollars

Supporting Documents

Attach the following, where applicable:

Exporter Declaration Letter that an IC is required

End-User Declaration Letter that the goods to be imported are for the end user’s own use, if the end-user is a local party

End-User Statement, if the end-user is a foreign party

If you are re-exporting the goods from Singapore, an export licence (and its English translation) from the exporting country, or a confirmation from the exporting country that they do not control the re-export of the goods

Technical specifications and other relevant documents

Submission, Fees and Processing

Submit the application and documents via the Networked Trade Platform (NTP).

A S$10 processing fee applies per IC application (deducted via IBG).

Processing typically takes 2 working days after all documents and payment have been received.

Approval and Validity

Upon approval, Singapore Customs will issue an endorsed ICDV copy via email. You should keep a copy for your own records and forward one copy to your exporter in the exporting country.

Each IC is valid for 1 year, and goods must be imported within this period.

To extend an IC, submit an application via NTP at least 14 days before expiry. Processing typically takes 2 working days after all documents have been received.

Conditions of IC

Under an approved IC, you must not:

Import the goods or cause or allow them to be imported into any country besides Singapore;

Dispose the goods before they are imported into Singapore; or

Export the goods or cause or allow them to be exported from Singapore after they have been imported into Singapore, except with Customs’ written approval.

Importing Goods under an IC

After IC approval, you must obtain an import permit via TradeNet before the goods arrive in Singapore.

When applying for an import permit, ensure that you:

Declare the respective ICDV number (e.g., ICDV/892/2025) in the CA/SC Product Code field for each item. You may import goods under different ICs using a single import permit.

Declare quantities and units in the CA/SC Product Quantity-UOM field exactly as stated in the IC.

Do not combine ICDV items with non-ICDV items in the same permit application.

Upload the approved ICDV, commercial invoice, bill of lading / airway bill, and packing list in TradeNet.

Your import permit will be processed only after all required documents have been submitted.

Delivery Verification (DV)

After the goods have been imported, apply for a DV if requested by the exporter

There are 2 types of DV:

Partial Delivery Verification – for goods arriving in multiple shipments

Complete Delivery Verification – once all goods under the IC have arrived

Applying for a DV

Submit your DV application and documents via the NTP within 14 days after the goods have arrived in Singapore.

Ensure the ICDV number is declared on the import permit.

Supporting Documents

For both partial and complete DV applications, submit the following:

Importer’s ICDV

Copy of import permit(s)

If the documents are in order, Singapore Customs will endorse the declaration letter and email it to you.

Once a complete DV is endorsed, you should send it to the exporter without delay.

Processing Time

DV applications are typically processed within 2 working days after all documents have been received.

Re-exporting Goods Imported Under an IC

You must obtain Singapore Customs’ approval before re-exporting goods imported under an IC.

If re-export is stated in the IC, you may apply for an export permit.

If re-export is not stated, seek Customs’ approval with the required supporting documents before applying for an export permit:

End-User Statement from the foreign end-user

Export Licence (and its English translation) from the foreign exporting country, or a confirmation from the exporting country that they do not control the re-export of the goods.

Obtain a strategic goods permit if you are re-exporting strategic goods.

An export licence (and its English translation) from the foreign exporting country, or a confirmation from the exporting country that they do not control the re-export of the goods.

Changes and Cancellation

You must inform Singapore Customs in writing:

immediately on any changes to IC information

at least 14 days before any transfer of ownership. The new owner of the goods should also submit a New Ownership Declaration Letter that the goods are for their use only.

If you do not intend to import after obtaining an IC, submit a cancellation request via NTP at least 14 days before IC expiry, with an exporter’s declaration confirming that the goods have not been exported to Singapore.

Processing typically takes 2 working days after all documents have been received.

Penalties for Non-Compliance

Singapore Customs may inspect goods imported under an IC.

It is an offence to breach any IC condition, or provide false or misleading information.

Offenders may face a fine of up to S$100,000 or three times the value of the goods (whichever is greater), or imprisonment of up to 2 years, or both. Heavier penalties apply for subsequent offences.