Trade Security In Singapore

Singapore Customs works together with local and international partners to safeguard Free Trade Zones, licensed facilities, and cross-border movements of goods against money laundering, terrorism financing and other trade-related risks through strong regulation, enforcement, and measures.

On this page

Singapore’s Trade Security

Safeguarding trade security is integral to Singapore's economic growth. Singapore Customs adopts a whole-of-society and layered approach and works closely with local enforcement agencies and international partners to secure the supply chain and combat illicit trade which includes:

Duty and tax evasion

Intellectual Property Rights (IPR) infringement

Smuggling of wildlife, parts, and derivatives protected under the Convention on International Trade in Endangered Species of Wild Fauna or Flora (CITES)

Money laundering and terrorism financing

Violations of United Nations Security Council (UNSC) sanctions

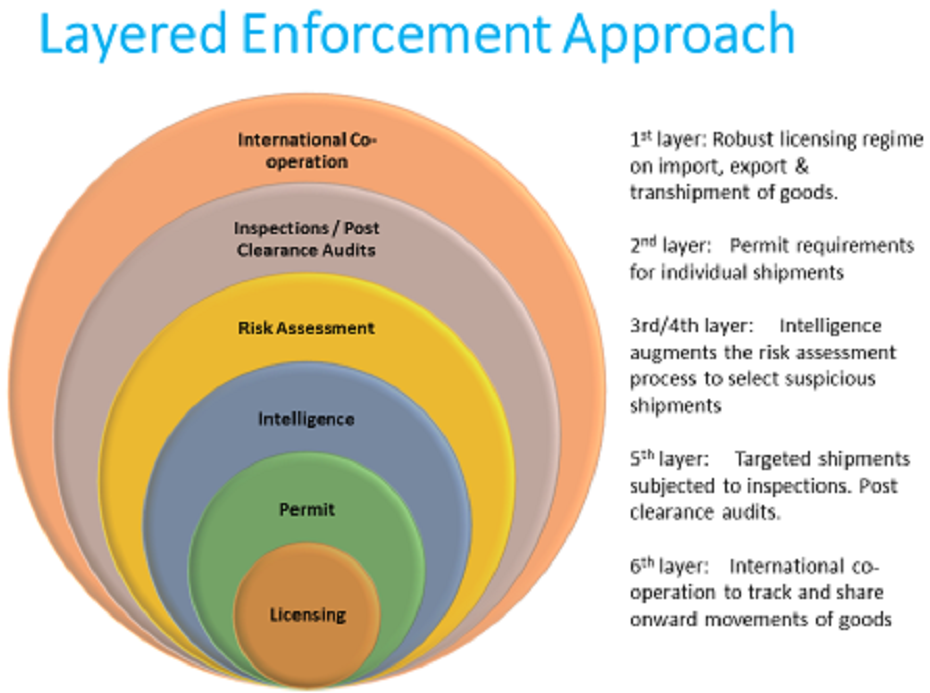

Singapore Customs’ layered enforcement approach combines licensing, permits, intelligence, risk assessment, inspections, and international cooperation to mitigate trade-related risks.

Anti-Money Laundering and Countering the Financing of Terrorism

Maintaining the effectiveness of Singapore’s Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) regime requires coordinated efforts across government agencies, industry partnerships, and international cooperation. Singapore published its updated ML National Risk Assessment on 20 June 2024, reflecting evolving risks and emerging threats.

In support of Singapore’s whole-of-society approach to preventing, detecting, and enforcing against money laundering and terrorist financing, Singapore Customs has implemented the following measures.

Strengthened Controls in Free Trade Zones and Licensed Facilities

Singapore Customs has enhanced regulatory oversight in high-risk areas vulnerable to money laundering and terrorist financing including Free Trade Zones (FTZs) and Zero-GST Warehouse Scheme (ZGS) licensees storing listed goods. These measures mitigate the risk of criminal misuse while supporting legitimate trade activities.

Regulatory Framework of Free Trade Zones

Singapore’s Free Trade Zones (FTZ) play a critical role in building Singapore’s position as a trading hub. Regulatory controls are in place to ensure to govern the security of the FTZs.

All transactions and activities within the FTZ must comply with all laws and regulations in Singapore, which empower government authorities to impose controls on the FTZ and undertake enforcement action such as routine checks and operations against illicit trading activities. FTZ operators do not receive exemptions or special treatment.

Revised FTZ Regime (Effective 1 March 2024)

To strengthen governance and mitigate criminal misuse within FTZs, Singapore Customs has revised the FTZ regime. Key changes include:

1. New Licensing Framework for FTZ Operators

Entities seeking to operate any FTZ must be licensed as FTZ Operators. Applicants must ensure the proper and efficient functioning of FTZ and comply with the security and reporting requirements of Singapore Customs. Their responsibilities include:

Managing and securing the FTZ

Supporting Singapore Customs officers in carrying out duties within the FTZ under the FTZ Act and other laws

Implementing systems and procedures to monitor and ensure the security of the FTZ

2. Shipping agents and FTZ cargo handlers to provide information

Shipping agents must submit cargo-related information to specified FTZ cargo handlers, who are required to transmit this data to Singapore Customs via system-to-system transmission. These measures enhance visibility of goods within FTZs and improve risk profiling and targeting of high-risk cargoes, including suspected trade-based money laundering (TBML) cases.

Enforcement within FTZs

Singapore Customs collaborates with the other Singapore agencies such as Singapore Police Force (SPF), Immigration and Checkpoints Authority (ICA), and other enforcement agencies to act promptly on actionable intelligence on illicit trade.

Singapore Customs also works with international counterparts, both bilaterally and through platforms such as the WCO Regional Intelligence Liaison Office, to share information and prevent illicit trade across borders.

Related features in inSYNC magazine:

Licensed Facilities Supporting Secure Trade

Singapore Customs administers schemes that balance facilitation and supply chain security:

Licensed Warehouse Scheme

Zero-GST Warehouse Scheme

Secure Trade Partnership programme

These schemes support business operations within controlled environments while ensuring supply chain security. Learn more about our schemes and licences.

Enhanced Zero-GST Warehouse Scheme (ZGS) Requirements

To mitigate money laundering and terrorism financing risks associated with the storage of precious stones and metals, artworks, antiques, and watches ("Listed Goods), ZGS licensees storing listed goods are subject to enhanced regulatory requirements. These measures allow Singapore Customs to have greater oversight of the activities in ZGS licensees' premises.

ZGS licensees storing listed goods must comply with the licensing conditions which include:

Seek Singapore Customs’ approval in writing to store the listed goods

Obtain “Intermediate” band and ZGS Type II licence under the TradeFIRST framework

Obtain, maintain, and update information on persons with control or beneficial ownership over the listed goods and screen the identities of such persons as part of Know-Your-Customer (KYC) checks

Inspections at ZGS

Regular inspections are conducted on these licensees to prevent companies from being inadvertently used as a conduit for money-laundering and terrorism-financing activities.

Related feature in inSYNC magazine:

Suspicious Transaction Reporting

Under Singapore law, traders have legal obligations to report suspicious transactions:

Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992

All traders—including freight forwarders and declaring agents—are legally obliged to file a Suspicious Transaction Report (STR) with the Suspicious Transaction Reporting Office (STRO) if they know or have reasonable grounds to suspect any property is connected to criminal activity during their trade, profession, business or employment. Failure to file a STR may constitute a criminal offence.

Terrorism (Suppression of Financing) Act 2002

Traders are legally obliged to provide information relating to property and financial transactions belonging to terrorist and acts of terrorism-financing to the Police or do so via a STRs. Failure to do so may constitute a criminal offence.

Traders may refer to Trade-Based Money Laundering (TBML) risk indicators to identify suspicious activities and file STRs when required.