Importing Personal Pets

Importing Personal Pets

The importation of goods, including pets, incurs Goods and Services Tax (GST). The GST for the importation of personal pets is based on the Cost, Insurance and Freight (CIF) value of the goods.

GST relief may be granted on the importation of personal pets if:

- The pet owner is changing his place of residence to Singapore and qualifies for GST relief. Please refer to the Importing Personal Pets for Transfer of Residence section below for the procedures to apply for GST relief; or

- The pet owner is a bona fide traveller or crew member and qualifies for GST relief. Please refer to the Importing Personal Pets for Overseas Travel section below for the procedures to apply for GST relief; or

- The pet is imported by air as manifested cargoes and the total CIF value does not exceed S$400. The table below illustrates the procedures and requirements for importing personal pets.

The National Parks Board (NParks) Animal and Veterinary Service (AVS) regulates all importation of live pets. Importers must comply with NParks’ AVS’ import licence and pet quarantine requirements and obtain approval before importing the pets from overseas.

Procedures & Requirements for Importing Personal Pets for Transfer of Residence

An importer who is transferring residence to Singapore (including returning Singaporeans, Permanent Residents, and foreigners) may be granted GST relief on the importation of his / her personal pet(s) subject to the following conditions:

- He / She is changing the place of residence from outside of Singapore;

- He / She is the owner of the pet(s) imported;

- He / She gives an undertaking not to dispose of the pet(s) within 3 months from the date of importation of such pet(s); and

- The pet(s) has been in his / her ownership for a period of not less than 3 months;

- The pet(s) is / are imported within 6 months of the pet owner’s first arrival in Singapore.

-

If the pet owner is not accompanying his / her personal pet on the same conveyance, the pet owner or his / her freight forwarding agent must obtain NParks AVS’ approval before submitting an online Declaration of Facts (DOF) to Singapore Customs for assessment on eligibility for GST relief. Please note that only one DOF can be applied for each Airway Bill or Bill of Lading. The DOF must be submitted at least 5 working days before the pet's arrival in Singapore. Click here for enquiries on the DOF application status.

If the DOF application is approved, the pet owner, his / her freight forwarding agents or pet clearing agent may inform their appointed Declaring Agent to obtain the Customs In-Non-Payment (GST Relief) permit within 10 working days from the approval date of the DOF. A list of freight forwarding agents can be obtained here.

If the DOF application is unsuccessful, a Customs In-Payment (GST) permit must be obtained to import the pet instead. For more details, please refer to the table below on the Procedures and Requirements for Importing Personal Pets. -

For personal pets that are accompanied by the pet owner on the same conveyance, the pet owner must obtain NParks AVS’ approval, before completing an “Application for GST Relief for Hand-Carried Used Household Articles, Hand-Carried Personal Effects, or Accompanied Personal Pets(where there is change in residence)" form. The application form must be submitted at least 5 working days before the pet’s arrival in Singapore with the following supporting documents for verification:

- NParks AVS’ approval for the importation of personal pets; and

- Personal identification and pass details.

Returning Singaporeans & Permanent Residents working/studying overseas

- Copy of passport and identity card (NRIC);

- Proof of employment overseas (e.g., work permit visa, employment pass, letter of appointment); and

- Proof of overseas study (e.g., student visa, student pass).

Foreign citizens transferring residence

- Copy of passport or identity card (FIN);

- Proof of transfer of residence to Singapore (e.g., employment pass, dependent pass, student pass); and

- Other supporting documents (e.g. letter of employment or letter of undertaking from the local employer or in-principle approval from the Ministry of Manpower).

Clearance of Accompanied Personal Pets

If the application is approved, the pet owner will receive an approval email on his / her successful GST relief application, which must be presented to the checkpoint officer at the Red Channel for their verification on the day of collection of the pets.

If the pet owner does not have an approval email from Singapore Customs (e.g. pet owner did not submit the full set of supporting documents at least 5 working days before the pet’s arrival in Singapore or does not qualify for GST relief), he / she must obtain a Customs In-Payment (GST) permit to pay the GST to import the pet instead. For more details, please refer to the table below on the Procedures and Requirements for Importing Personal Pets

Click here for a step-by-step guide to pet immigration in Singapore.

Procedures & Requirements for Importing Personal Pets for Overseas Travel

A bona fide traveller who is the holder of a visit pass or bona fide crew member who is not resident in Singapore may be granted GST relief on the importation of his / her personal pets subject to the following conditions:

- That such person satisfies the proper officer of customs that:

- The person is the owner of the pets imported;

- The person is temporarily importing the personal pets to travel with the person for the whole or part of the duration of person’s stay in Singapore; and

- The person intends to re-export the personal pets when the person leaves Singapore.

- That the pets are re-exported within 6 months beginning on the date of the person’s arrival in Singapore; and

- That the tax is payable if the pets are sold, disposed of or transferred locally.

A bona fide traveller or crew member who is resident in Singapore may be granted GST relief on the importation of his / her personal pets subject to the following conditions:

- That such person satisfies the proper officer of customs that:

- The person is the owner of the pets imported;

- The personal pets were temporarily exported to travel with the person for the whole or part of the duration of the person’s overseas travel;

- The personal pets were supplied in or imported into Singapore before their export; and

- The personal pets are being re-imported upon completion of overseas travel.

Procedures for Personal Pets

For importation of the personal pets for overseas travel, the pet owner must obtain NParks AVS’ approval, before completing an “Application for GST Relief for Personal Pets (where there is overseas travel)” form. The application form must be submitted at least 5 working days before the pet’s arrival in Singapore with the following supporting documents for verification:

- Bona fide traveller who is the holder of a visit pass or bona fide crew member who is not resident in Singapore:

- Copy of passport;

- Arrival and departure flight itinerary indicating the pet(s) is part of the hand-carry or checked-in baggage;

- National Parks Board’s Animal and Vetinerary Service (NParks’ AVS) import and export licence;

- Pet licence, vaccination record or purchase invoice; and

- Bill of Lading, Air Waybill or Delivery Note (if imported/re-exported as manifested cargo).

- Bona fide traveller or crew member who is resident in Singapore:

- Copy of passport;

- Copy of identity card (NRIC/FIN);

- Arrival and departure flight itinerary indicating the pet(s) is part of the hand-carry or checked-in baggage;

- NParks’ AVS import and export licence;

- Pet licence, vaccination record or purchase invoice; and

- Bill of Lading, Air Waybill or Delivery Note (if imported/re-exported as manifested cargo).

Clearance of Accompanied Personal Pets

If the application is approved, the pet owner will receive an approval email on his / her successful GST relief application, which must be presented to the checkpoint officer at the Red Channel for their verification on the day of collection of the pets.

If the pet owner does not have an approval email from Singapore Customs (e.g. pet owner did not submit the full set of supporting documents at least 5 working days before the pet’s arrival in Singapore or does not qualify for GST relief), he / she must obtain a Customs In-Payment (GST) permit to pay the GST to import the pet instead. For more details, please refer to the table below on the Procedures and Requirements for Importing Personal Pets.

Click here for a step by step guide to pet immigration in Singapore

Procedures & Requirements for Importing Personal Pets

| Scenarios | Procedures | Remarks |

|---|---|---|

| Importation of pets for permanent or long term stay in Singapore By Air, Land or Sea |

GST is payable on all imports unless GST import relief is granted, or the CIF value does not exceed S$400 for import by Air. Pets owners are to appoint a freight forwarder or pet clearing agent to obtain a Customs In-Payment (GST) permit before collecting the pets. A list of these freight forwarders/declaring agents can be obtained here. |

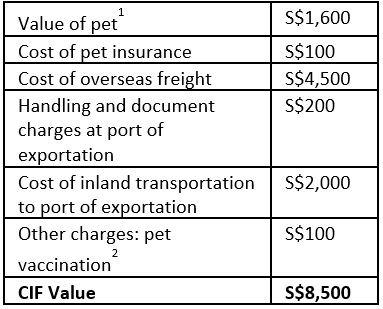

You may refer to the illustration example below. Example: Pet Owner bought 1 pet dog from Pet Supplier A on Ex Works (EXW) incoterms.  Therefore, the customs value should be the sum of all costs, which is S$8,500. Therefore, the customs value should be the sum of all costs, which is S$8,500.Note: 1 Where there is no sales transaction, the value to be indicated shall be based on the transaction value of identical or similar goods from the same country of origin that is exported at about the same time or the original price payable for the goods as if they are sold for export from the country, inclusive of freight and insurance charges that are incurred for the shipment 2 Pet vaccination costs shall include work treatment, veterinary health clearance, endorsement and export permit / licence, external parasite treatment etc. The pet owner must apply and obtain Nparks AVS’ approval for the necessary import licences in advance, before applying for the Customs In-Payment (GST) permit to pay the relevant GST. Please note that the Customs In-Payment (GST) permit approval for pets typically takes up to 3 working days. Please furnish all the abovementioned documents to your appointed agent, prior to the permit application to avoid any delay in collecting your pet(s). |

| Temporary importation of pets for approved purposes with intention to export them out of Singapore (for breeding, exhibition, veterinary, treatment, etc.) |

GST is not payable. A Customs In-Non Payment (Temporary Consignments) Permit should be obtained. To re-export the same pets, a Customs Out (Temporary Consignments) permit should be obtained. |

The importer should apply for and obtain the necessary import licences from NParks AVS in advance before applying for the temporary importation of the personal pets. The importer/appointed freight forwarder/pet clearing agent is required to submit the following information via the Customs Documentation Enquiry Form: 1. Cover letter stating: - Purpose of temporary import - Duration of import - Venue where the pets will be imported into 2. Nparks AVS import licence 3. Invoice 4. Bill of Lading/Airway Bill (if applicable) 5. Any other documents as specified by Singapore Customs The maximum period of temporary importation is 6 months, after which the pets must be re-exported. |

-

Note: Where there is no sales transaction, the value to be indicated shall be based on the transaction value of identical or similar goods from the same country of origin that is exported at about the same time or the original price payable for the goods as if they are sold for export from the country, inclusive of freight and insurance charges that are incurred for the shipment. ↩

-

Pet vaccination costs shall include work treatment,

veterinary health clearance, endorsement and export permit / licence, external parasite treatment etc.*

The pet owner must apply and obtain Nparks AVS’ approval for the necessary import licences in advance, before applying for the Customs In-Payment (GST) permit to pay the relevant GST. ↩